Hits:Updated:2022-02-26 14:02:27【Print】

The container shipping market has experienced losses for more than ten years and has now achieved record profits. Can oil tankers realize the transformation from losses to huge profits and also take a share of it? Concordia Maritime, a troubled oil tanker operator in Sweden, is considering pulling out of its sluggish tanker business in a bid to make a fortune in the current container shipping market.

Concordia Maritime, which was rescued by Stena after suffering heavy losses last year, has revealed a tanker conversion plan.

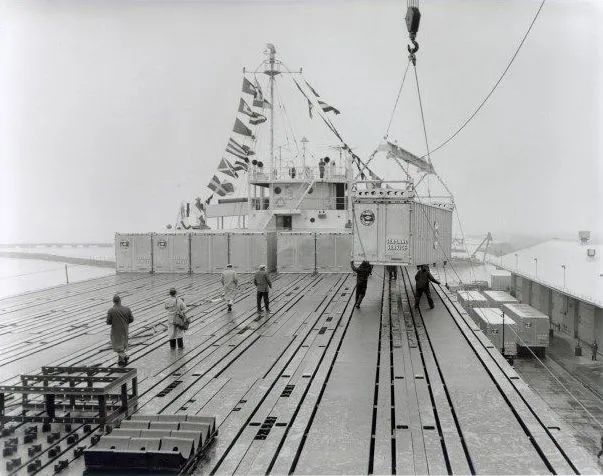

While dry bulk ships have been seen transporting containers over the past 6 months, the conversion of tankers to containers has not been seen since Malcolm Mclean invented container shipping 66 years ago The practice of ships being used to transport containers.

Bulk Carrier Shipping Containers

Concordia Maritime initiated a technical design study with Stena Teknik and a German consultancy specializing in ship design. The purpose is to study the feasibility of converting P-MAX product tankers to container transport. Also includes preparation for basic design class approval.

"The container business has shown strong growth in recent years, driven by disruptions to international logistics and more structural factors," Concordia Maritime said in a press release yesterday.

According to preliminary assessments, it is entirely possible to convert the P-MAX ship into a container ship with a capacity of about 2,100 TEU in consideration of its redundant twin engines and other space dimensions.

The technical design study is expected to be completed in the second quarter of 2022, and if all goes well, discussions with shipyards and potential charterers will follow to explore potential interest. A full refit is expected to take approximately 3 to 5 months. Concordia Maritime currently owns a total of nine P-MAX tankers.

Consolidation market trends

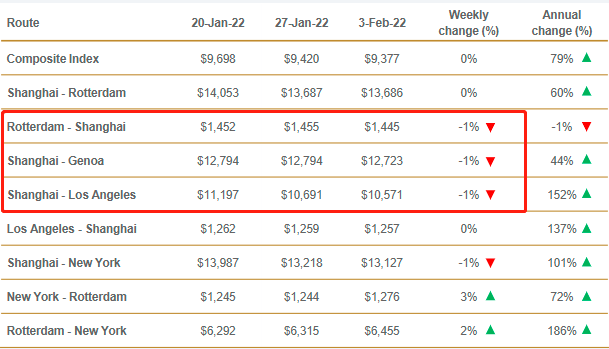

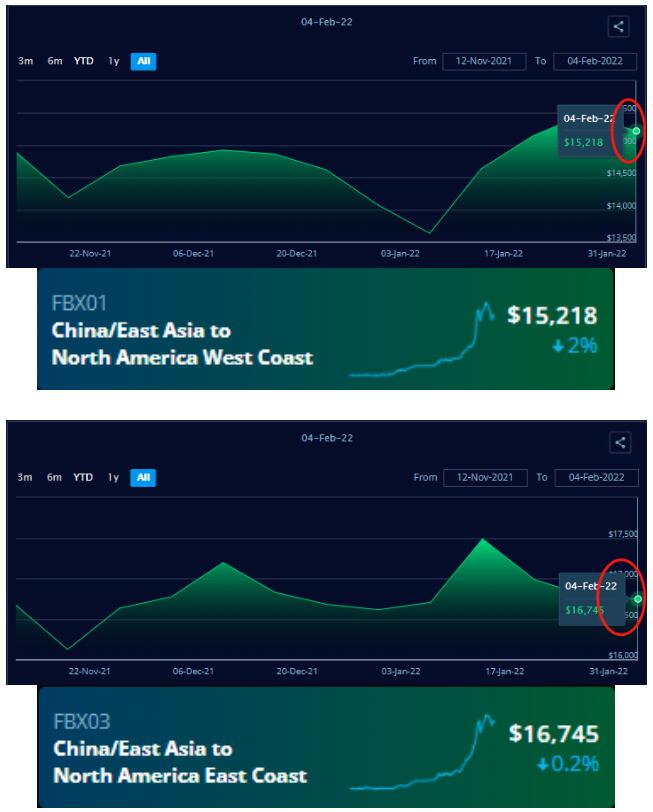

The latest edition of Drewry's World Container Index Composite Index edged down 0.5% to $9,376.70/FEU, but was still 79% higher than the same period in 2021. Shanghai-Los Angeles and Shanghai-New York rates fell 1% to $10,571/FEU and $13,127/FEU, respectively. Likewise, Shanghai-Genoa rates fell 1% to $12,723/FEU.  The latest issue of the Baltic Sea Freight Index (FBX) shows that the freight rate from China to the US West fell 2% to US$15,218/FEU; the freight rate from China to the US East fell 0.2% to US$16,745/FEU.

According to industry analysts, it is impossible for freight rates to remain high all the time. Due to the reduction in demand during the Spring Festival holiday, the decline in freight rates reflects market demand. Such a pullback trend is normal. Whether the market reverses downward or not, the rate of decline in future freight rates is an important indicator to observe, as long as there is no crash-like decline, don't worry too much.

According to a person in the freight forwarding industry, the transaction price of both the trans-Pacific route and the European route is currently maintained at a high level. After the Spring Festival, China will start production one after another, and it is expected that the freight rate will continue to adjust. However, in the next two months, the US-West docker contract will be negotiated. According to past practice, if the negotiation fails, it may lead to sabotage or even strike. The cargo owner purchases goods in advance, which will further increase the demand for transportation capacity in the first quarter and support the high freight rate. It is estimated that the high freight rate will be maintained until at least the second or third quarter.

Back to the origin?

It is worth mentioning that as early as 1956, Malcolm Mclean purchased two WWII-era T-2 tankers, which were refitted to load containers on and below deck (see photo below), open ushered in the era of sea container trade. Now, is Concordia Maritime's operation back to square one?

Refitted T-2 tankers at the time loaded with containers on and below deck

Concordia Maritime is an international tanker shipping company engaged in the transportation of refined petroleum products and vegetable oils. Listed on Nasdaq in 1984. In the face of the continuous upsurge of ordering oil product tankers, the company's CEO Kim Ullman called on the tanker shipping industry in 2021 to jointly resist the temptation to build new ships and restore the balance of supply and demand in the market.

The CEO said at the time that if product tankers are to be profitable in 2021, the market must have the following conditions: First, tanker operators do not increase capacity and avoid ordering new ships. Second, oil production and oil consumption need to continue the expected positive trends. He said that in recent years, the capacity of the tanker fleet has far exceeded demand, so there is no need and should not continue to order new ships, so that the market can return to balance.

|