Hits:Updated:2022-02-26 14:02:57【Print】

"Now it takes about a month in advance to get a space in order to book a space. We exported a shipment of goods to Vietnam this month. If we book a ship more than a week in advance, we will not be able to catch up with this month's shipping schedule." The relevant person in charge of the export sales department of a company in Guangzhou People say so. Entering the Year of the Tiger, many foreign trade enterprises in Guangzhou have started construction one after another. However, the reporter's investigation found that the "box worry" is difficult to solve, and the tight shipping space and high prices still plague foreign trade enterprises. The last issue of China's export container freight index reached 3587.91 points, a new high. Although the latest index fell.

Behind the problems of shipping container capacity and freight rates is the imbalance between supply and demand caused by the global epidemic. For the shipping prices that have been soaring for two years, industry insiders and industry analysts all predict that the overall freight rate in 2022 will remain at a high level.

After the holiday: multi-routes need to book cabins 1 month in advance

The relevant person in charge of the export department of a chemical manufacturing enterprise located in Nansha, Guangzhou told reporters that the company has put into production on the seventh day of the new year, and the orders are currently very popular. However, the problem of tight shipping space and soaring prices has not been alleviated. Recently, there are goods to be exported to Australia. Although the space is booked in advance, the shipping schedule is still delayed by more than a week.

Since 2020, shipping space has become increasingly tight and prices have continued to rise, reaching a peak in the second half of last year, and has not eased since then. This is the case with global shipping. Take the current domestic shipping price to Southeast Asian countries as an example. Compared with 2020, the price has increased by 1 to 2 times.

Another company located in Guangzhou, Elise Daily Products Co., Ltd. mainly exports small household appliances, storage supplies, etc. According to the relevant person in charge of the company's international sales department, the degree of shipping tension in different destinations after the holiday is different. For example, the shipping to the United States still maintains the tension before the holiday, but the routes exported to some Southeast Asian countries have eased slightly. But it's still not easy to say.

"In the past, you could get the space one week in advance, but from the second half of last year to the present, the booking time for exporting to the United States or Southeast Asia and other countries requires a long time in advance, usually about a month in advance. We are exporting to Vietnam this month. If you book a shipment more than a week in advance, you will not be able to catch up with this month's shipping schedule," the person said.

Prices are also still high. For example, the container shipping price from Shenzhen port to New York port, although there was a price drop in January, but with the rebound of shipments after the festival, the price of each container is 2,000 US dollars more expensive than before the festival, reaching US$ 15,000, and it is still rising. . Compared with the beginning of 2020, it has increased by four or five times. At that time, the container price of this route was around 3,000 US dollars.

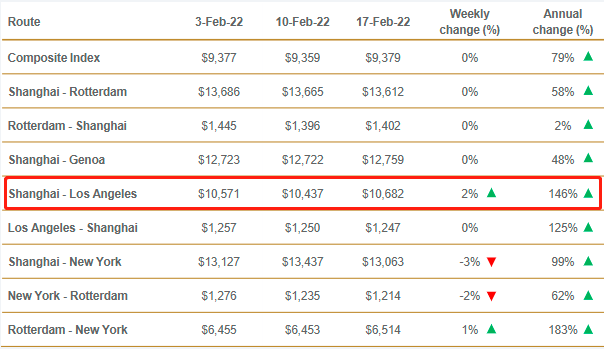

The latest issue of Drewry's freight index Shanghai to US West rose 2%.

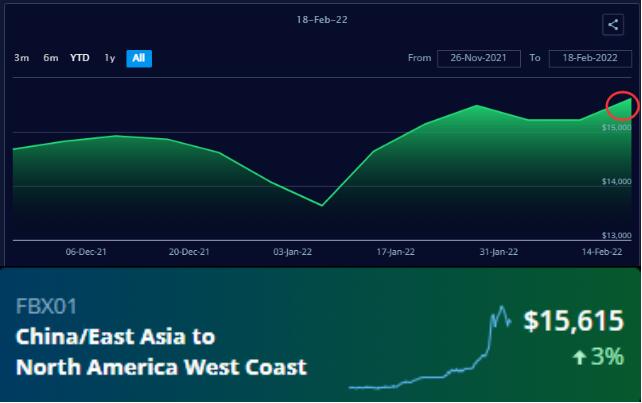

Pay attention to the latest Baltic Container Freight Index (FBX) in this issue. The data shows that the spot container freight rates for the Asia-West America and Asia-East America routes rose again; while the Asia-West America routes rose 3% to $15,615/FEU. FBX data shows:

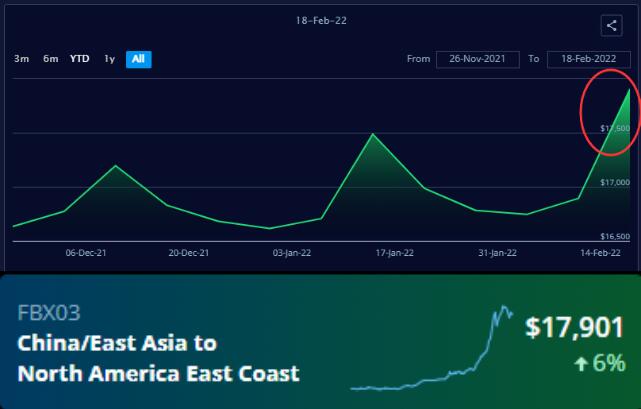

The freight rate from China to the US East was US$17,901 per 40 feet, up 6% from US$16,893 in the previous period.

Response: price hike of export products, advance booking and high price to grab space

According to public data from the Shanghai Stock Exchange, the “on-time rate of arrival and departure services” on global main routes from Asia to the West Coast of the United States was only 11% in January, continuing to maintain a low level. The price is constantly hitting new highs. According to the public data of the Shanghai Shipping Exchange, on February 11, China's export container freight index was 3587.91 points, a new high.

Looking forward to the market outlook, many industry insiders believe that from the perspective of shipping demand and capacity supply, it is expected that the overall freight rate in 2022 will remain at a high level. "Affected by the recent rebound of foreign epidemics, it is expected that shipping prices will rise again in the next wave. However, in the medium and long term, it is expected to gradually ease." The above-mentioned relevant person in charge of Alice also said.

Global shipping giant Maersk said in a report released at the beginning of the year that it is still having trouble transporting goods globally this year as it takes longer to ease congestion than it originally expected.

A recent research report from Huatai Securities also pointed out that looking forward to 2022, the high prosperity of the container transportation market is expected to continue, mainly due to the decline of supply chain turnover efficiency and port congestion and other problems that are difficult to alleviate in the short term.

The tight shipping space has affected the timeliness of shipments, and the high shipping prices have affected the profits of many foreign trade companies. During the interviews, most exporters responded by raising prices for some products, and at the same time, customers confirmed their shipping plans in advance and booked space in advance. "In the event of an emergency, you can only grab space at a high price." A relevant person in charge of shipping from an export company also revealed. Since this kind of trouble has lasted for more than a year, both enterprises and customers have become accustomed to this situation.

Shipping concept stocks surge in profit

Shipping prices have skyrocketed for two years, and shipping companies have made a "gorgeous turn" from a buyer's market to a seller's market, making a lot of money.

There are a total of 13 concept stocks in the A-share market that are mainly engaged in shipping business, of which 10 have announced their 2021 annual performance forecasts, and 8 are expected to increase. Net profit doubled.

As China's largest shipping company, COSCO SHIPPING Holdings' 2021 performance forecast shows that the company's net profit attributable to shareholders of listed companies in 2021 is approximately RMB 89.28 billion, a year-on-year increase of approximately 799.3%.

According to the performance forecast of CSC Phoenix, the company is expected to achieve a net profit of 80-120 million yuan attributable to the parent in 2021, a year-on-year increase of 659.81%-1039.71%.

|